Fintech, this term is the combination of “finance” and “technology”.

It refers to any enterprise taking the advantage of the technical solutions to develop an automated or high-performing financial process.

From insurance to cryptocurrency, investment apps to mobile banking, wealth management apps to personal banking, fetch domains take many shapes and sizes.

Thinking about fintech, probably you may think about new startup businesses that include cutting-edge technologies. But with a broad increase of usage of fintech solutions, the traditional finance industries, as well as banking sectors, are also adapting it.

Fintech applications differ significantly from project to project. Several of them use data science technologies, machine learning algorithms, and cutting-edge technologies like blockchain to perform different tasks.

You may say, this is a brand new industry. Yes, certainly it is. It has evolved rapidly during the last decade.

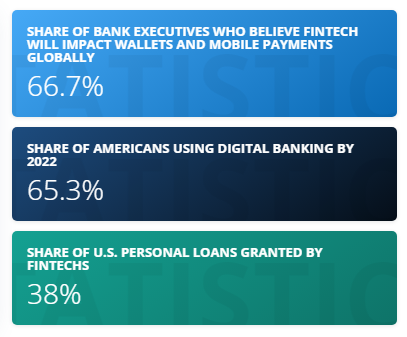

So, let’s see what statistics are saying..

Contents

FinTech Statistics

Obviously, the development of technology to gather shifting needs within the financial segment is not new.

However, today’s fintech is changing the old systems at an unexpected pace. Fintech has quickly included in our daily life as well.

Source: statista.com

This combines with the skill of digital finance to level the field as long as more fair access to service guides to consider the reach of change today.

In addition to this, the changes of consumer behaviors during COVID-19 resulted in new booming possibilities for the fintech industries.

As the fintech domain continues to gain thrust, different sectors are also adopting this solution.

Source: Tipalti

The Key Challenges

I think we have made enough discussion regarding the Fintech domain and its outcomes. But certainly, we need to build this. There is no pre-developed theme like the fintech app is available.

And tech experts need to develop it from scratch.

Now let’s see what are the common challenges you can face for fintech app development?

Never miss an update for us. Join 10,000+ marketers and leaders.

Understanding the Business Logic

Each single product or any techno development journey always begins at square one – discovering a market gap and identifying a solution you can implement within your application to fill it.

This stage is quintessential to the overall success of the project, but many people overlook its application on consecutive stages.

If you are planning to include a feature into your product – any feature – your justification needs to be better than it “looks and feels cool”, or “my competitors have it”.

Finding the Perfect Team

Most businesses face the age-old challenge when trying to build an effective fintech development team from the ground up: people with more technical backgrounds are not as well-versed in the business aspect and vice versa.

Well, here’s some food for thought. Should one focus on looking for talent with a financial background or will their experience slow down the technological innovation turning your product into the same old “bank with an app” just because it is safer that way?

Choosing the right Technology

What is a tech stack? In simple words, it is the combination of technologies (frameworks, programming languages, APIs, etc.) that one uses to develop a project.

A tech stack is usually divided between two core elements: The client-side: This is the part of the project users will interact with. Everything from interfaces to navigation and UX goes here.

The server-side: This is the part that ensures your software works as intended though it is not visible to the user.

Everything that’s taking place between the database and the server goes here. Both should be complimentary of one another. But how do you settle on the perfect tool for the job?

Let’s take a look at Artificial Intelligence (AI) and Machine Learning (ML), Big Data and Data Analytics, Robotic Process Automation (RPA), Blockchain.

It is the most widespread architectural language among fintech development projects, finance management firms, and banks for a reason.

Or several reasons, to be precise.

Make it Efficient to use

With the tech stack settled and the team onboard with mission and vision, designing the app is the next logical step.

Think about it: It takes a thorough understanding of what your audience wants and how they want it to develop a competitive fintech solution people will fall in love with from first glance (tap?).

Why? Well, if put simply, the design is more than a pretty interface or a set of user-friendly features. Those are necessary elements, sure, but they are highly subjective.

You will not be able to match everyone’s preferences. Nor should you even try.

Project Architecture

Not that every piece of the puzzle is in place, it is time to set the development process in motion based on the bigger picture – the architecture of your project.

This stage brings a series of decision-making challenges such as choosing card and payment processors, partnering platforms, a services vendor, etc.

On the one side, there’s a lot of SaaS solutions that offer a complex package for KYC, card, and payment processing.

They are relatively accessible and capable of dramatically enhancing time-to-market delivery.

On the other, these solutions often lack the flexibility needed to match the ever-changing regulatory requirements.

In the worst-case scenario, they will force you into an endless loop of sorting out legacy code issues. You don’t want to be running your project in the shoes of Sisyphus, do you?

I’ve worked with the team at AndolaSoft on multiple websites. They are professional, responsive, & easy to work with. I’ve had great experiences & would recommend their services to anyone.

Ruthie Miller, Sr. Mktg. Specialist

Salesforce, Houston, Texas

Conclusion

Yes, developing a fintech application from scratch is nothing short of a Herculean feat.

That being said, a proper mindset, dedication, and a certain level of pessimism (you’ll need it to always prepare for worst-case scenarios), paired with a will get you through.

Don’t forget the core principles of successful fintech application development while you are at it.

Want to develop your FinTech App? Let’s discuss!